Search for answers or browse our knowledge base.

Can't find the answer you need here? Contact our support team and we'll gladly help you.

🎥 Setting up VAT and sales tax

Light Blue’s quoting & invoicing features can manage all your needs, whether you don’t charge any tax on your sales, charge a single tax rate or several, or work with more complex tax packages.

To learn more about how to do this watch the video below; though if you prefer to learn by words and pictures, have a read of the help article instead! NB. The video was made prior to the different tabs in the finances section being introduced in the desktop app – simply make sure you are in the “VAT & Sales Tax” tab whilst following the steps in it.

Creating tax rates and setting the default

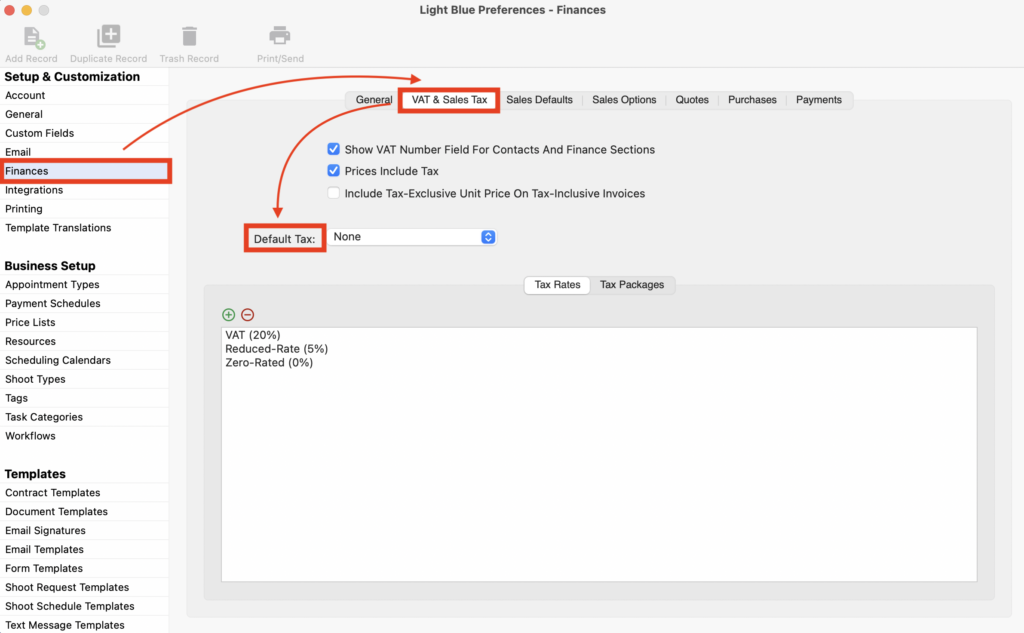

You can create as many tax rates and tax packages as you like within Light Blue; they’re all created in the Finances sections of Preferences under the “VAT & Sales Tax” tab. This is where you also set the Default Tax to be applied to your sales and invoices; though of course, you can amend that on a case-by-case basis should you need to.

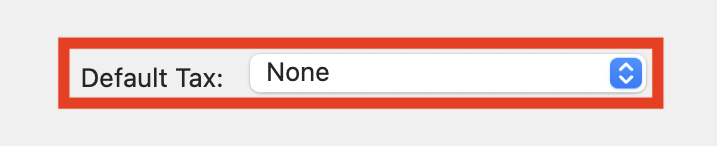

No tax charged

If you don’t charge tax at all you can set the “Default Tax” to “None” and no tax will be applied to your sales.

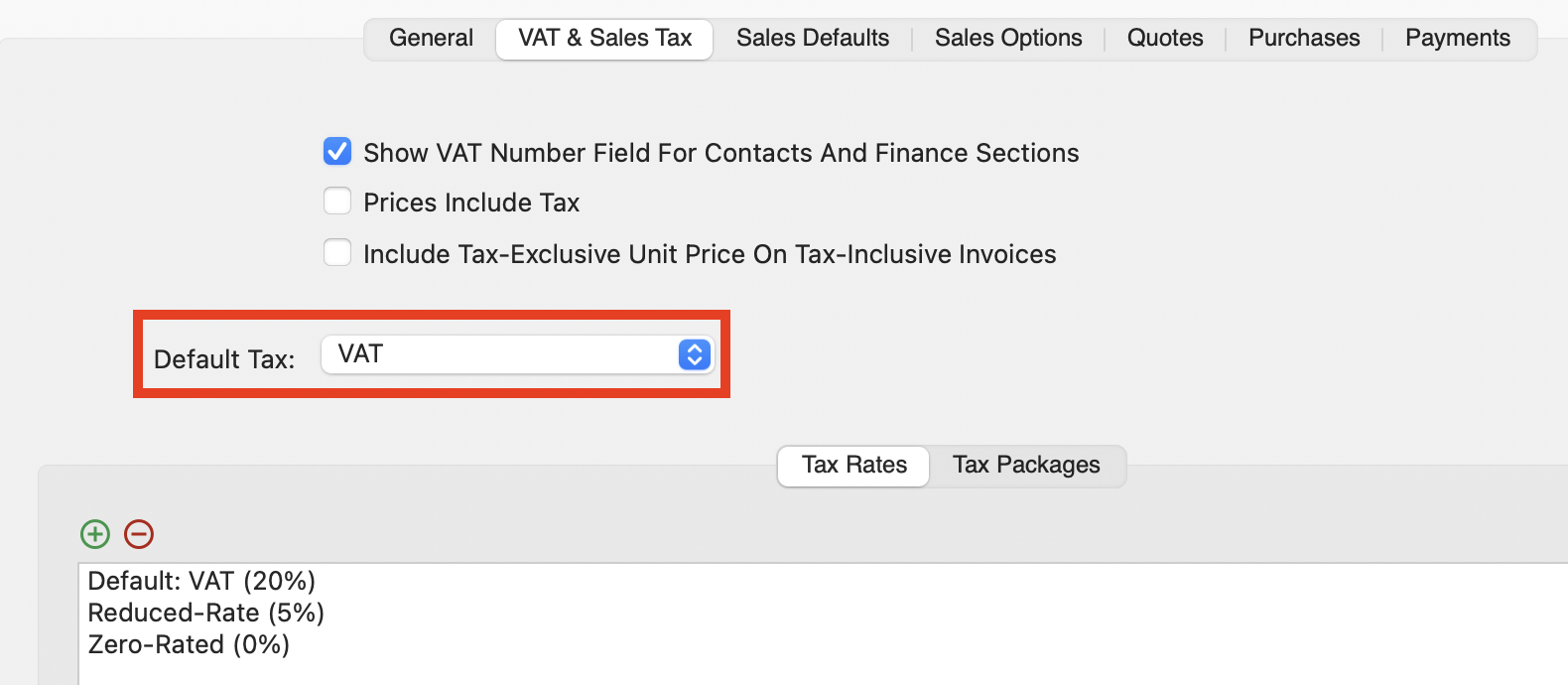

Single tax rate

Light Blue already comes pre-populated with a few tax rates; if one of them is applicable choose that as your default.

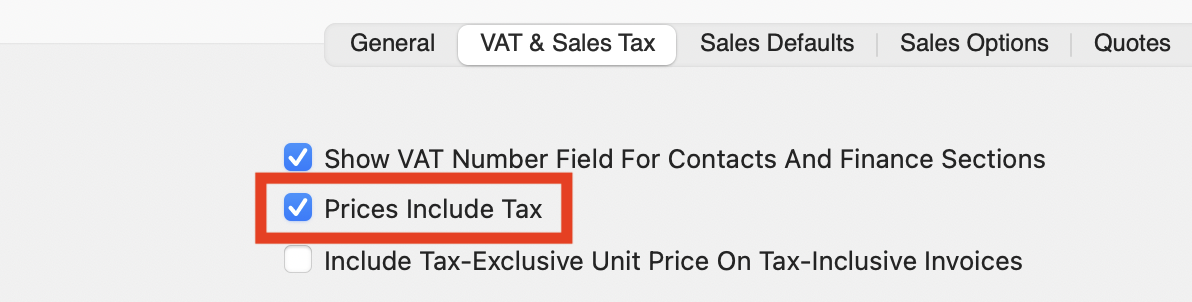

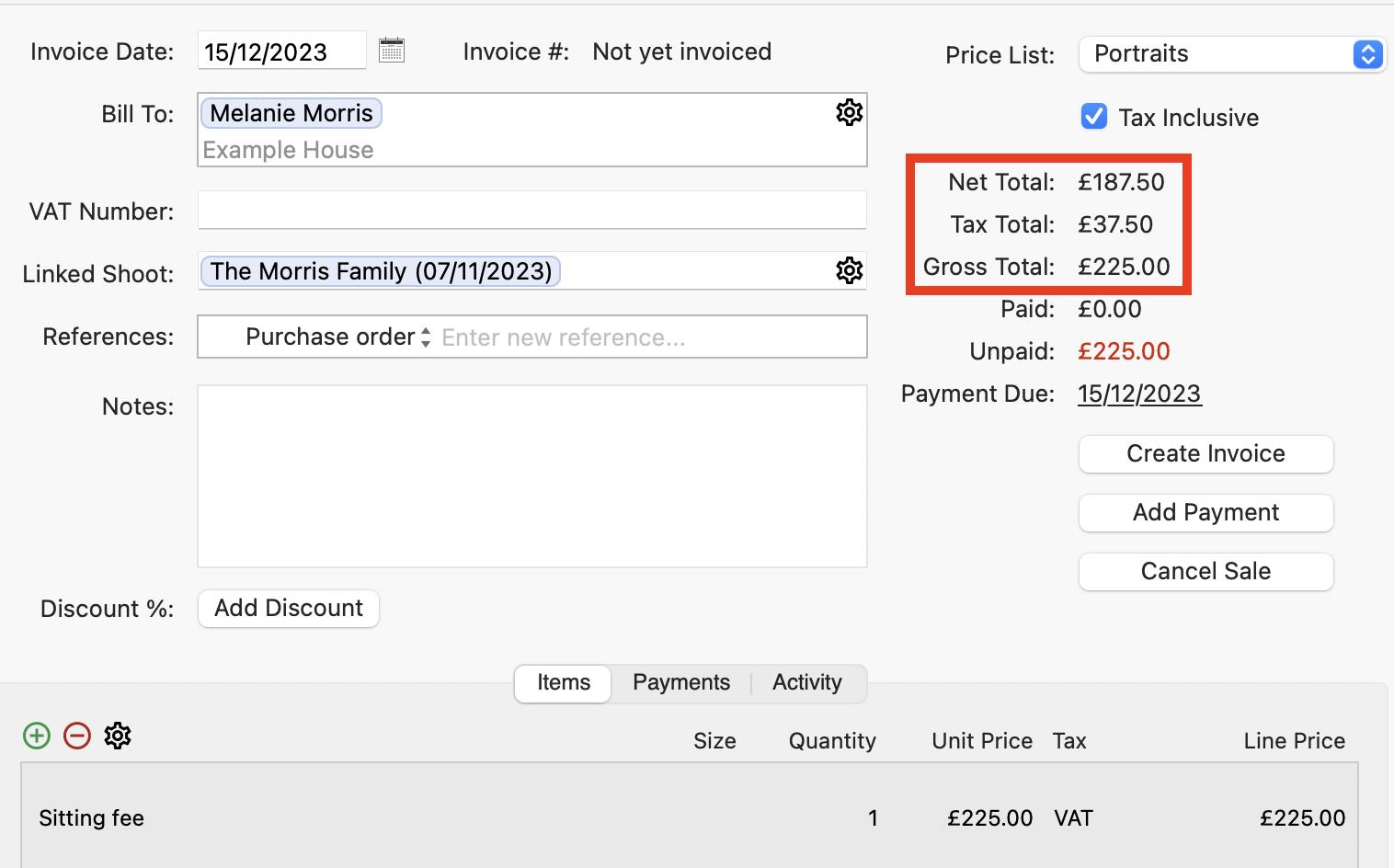

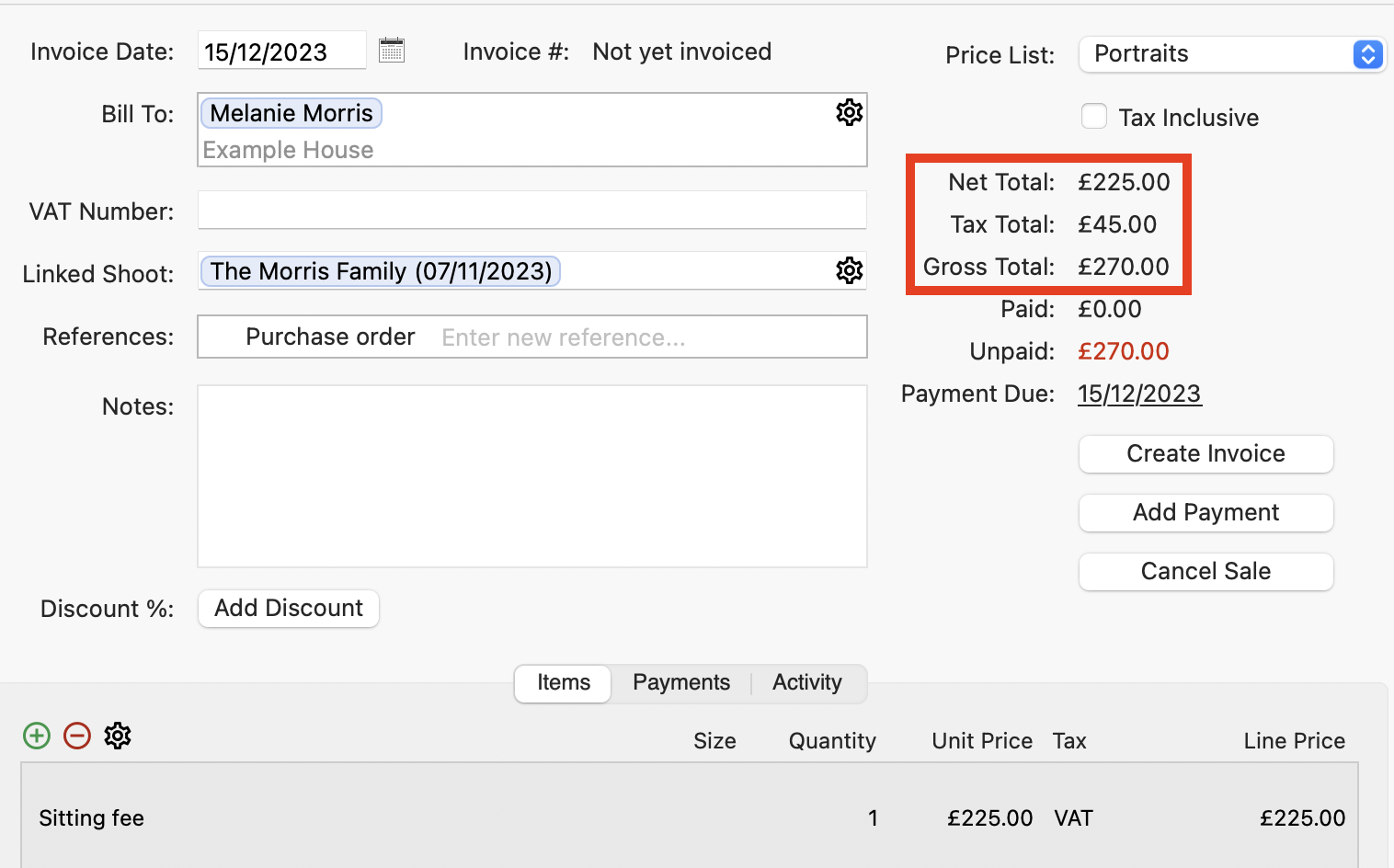

“Prices Include Tax” checkbox

Ensure you check or uncheck the “Prices Include Tax” checkbox as appropriate.

If it’s checked the prices in your Price List will be the Gross Total and Light Blue will calculate the Net and Tax Totals to show on your invoices.

If it’s unchecked the prices in your Price List will be the Net Total and Light Blue will calculate the tax to be added to your invoices.

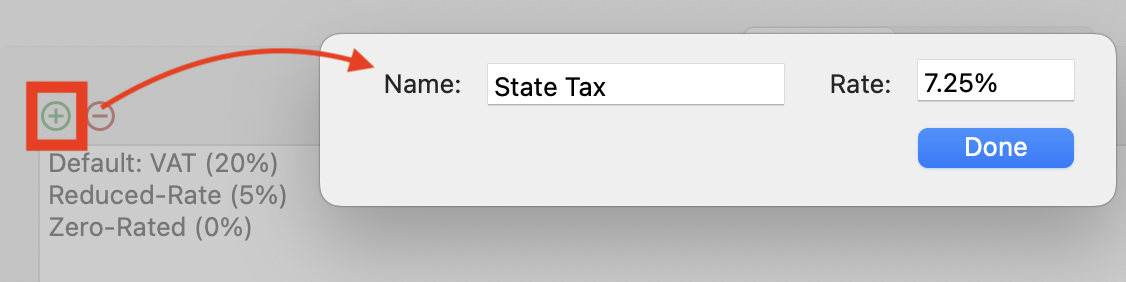

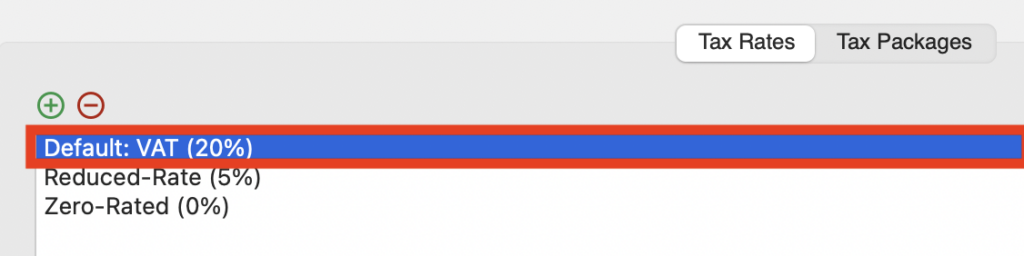

Adding a new tax rate

If you need to add another default tax rate simply click on the green “+” button to add one and complete the details. Or you can double-click on an existing one and amend it accordingly; if for example the VAT charged is different to the pre-populated value.

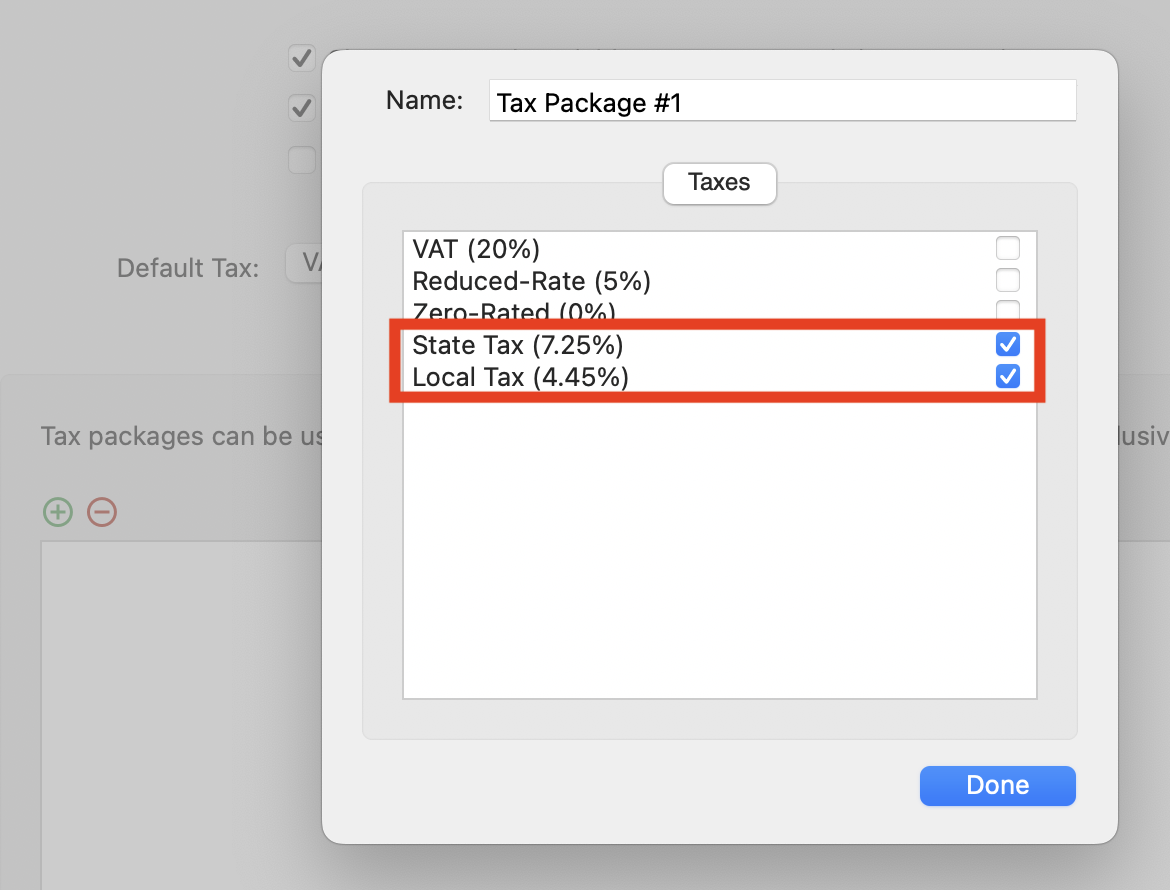

Tax Packages

If you have to apply a combination of different tax rates to your sales (e.g. in the USA it’s common to have to apply both state and local sales taxes), set up each individual tax in the Tax Rates tab and then combine them in the Tax Packages tab by clicking on the green “+” button, naming the package and selecting the combination of the single rate taxes that make up the package.

Changing the default tax applied

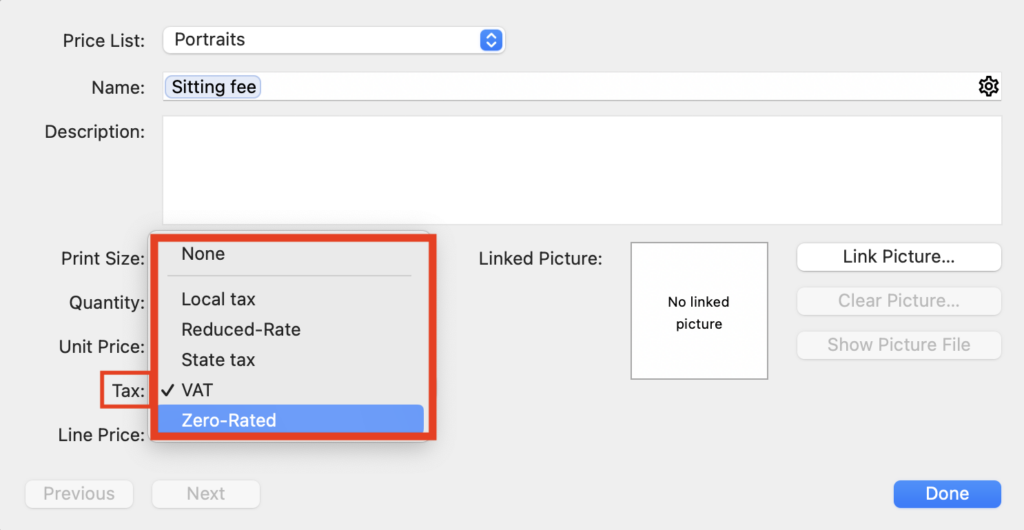

In a Sale Record

There may be times when you need to override your default tax rate for a particular sale. This is easily done by choosing the correct tax rate from the drop-down menu in the “Tax” field when you add an item to your Sale Record.

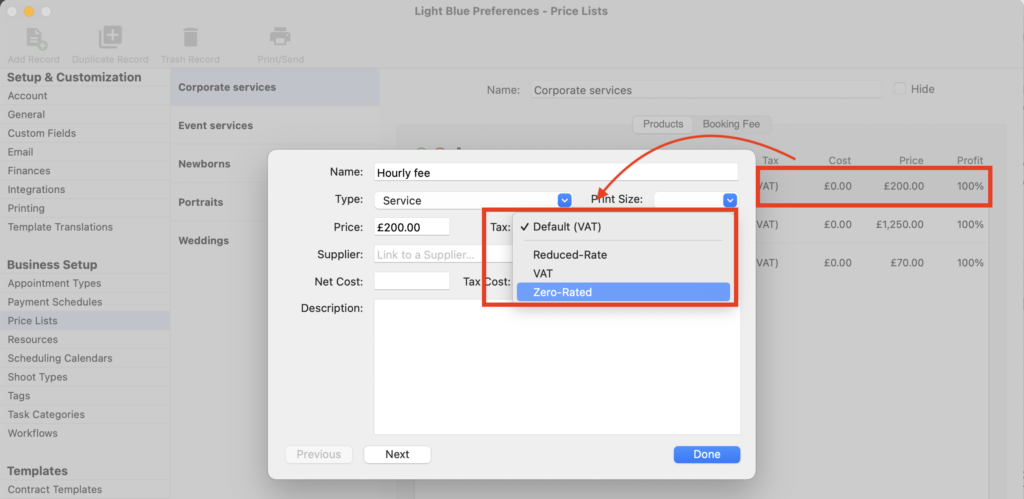

In a Price List

You can also override the default tax rate for any item in any Price List; simply click on it and choose the correct tax rate.

👉 And if you’ve not already set up your Price Lists in Light Blue head on over to this article.